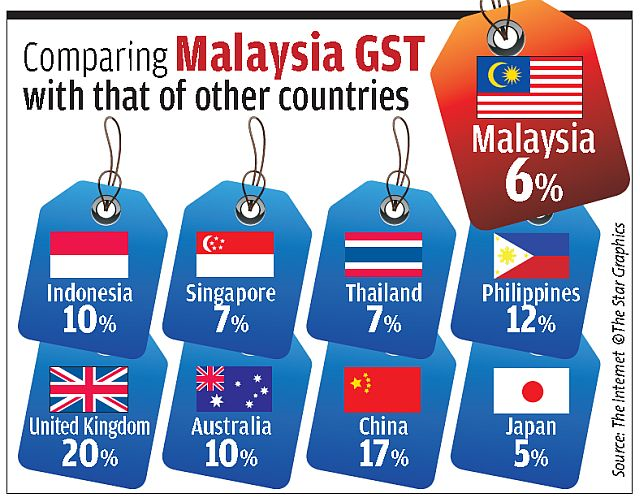

Assalamualaikum dan Salam 1Dunia, 1 April 2015 semakin hampir saat Malaysia akan memulakan Goods and Services Tax (GST) yang telah dibentang pada bajet 2014. Lebih 120 buah negara telah mengguna sistem GST dan Malaysia menjadi negara terbaru menggunakan sistem ini. Semakin dekat dengan tarikh 1/4/2015 semakin panas dengan berbagai usaha untuk mengagalkan daripada berbagai pihak bukan sahaja pembangkang malah bekas pemimpin Barisan Nasional.

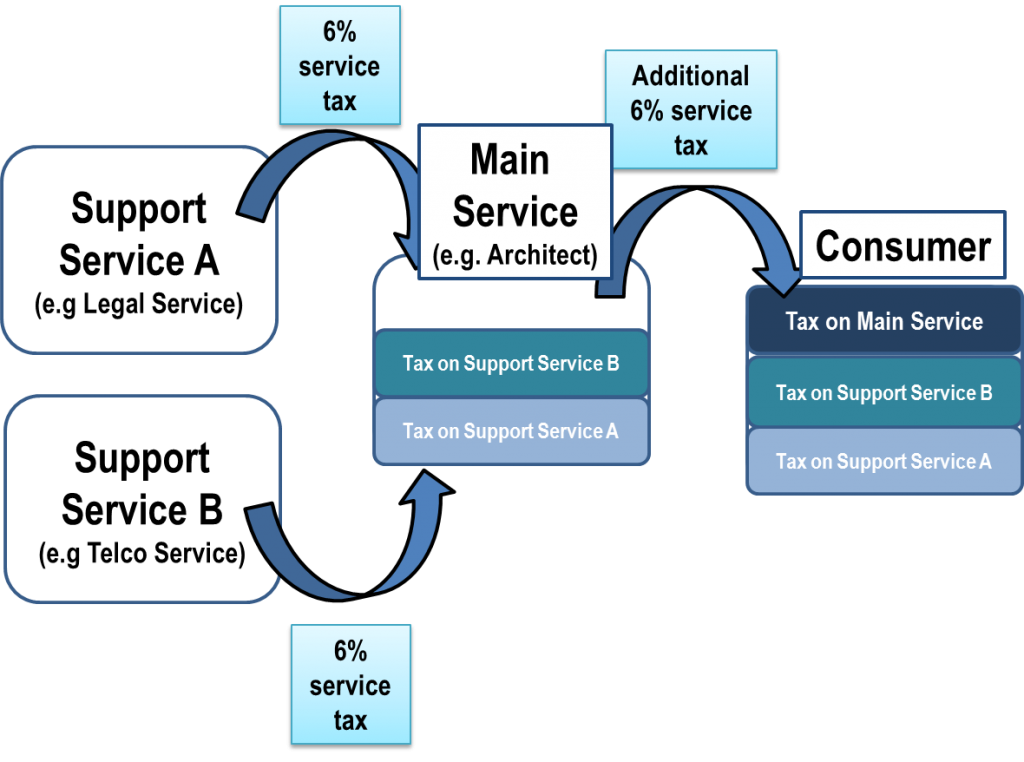

Pada pendapat aku banyak produk akan lebih murah apabila GST diperkenalkan dengan syarat Kerajaan memantau dan buat penguatkuasan yang bersungguh-sungguh dan ketat untuk enam bulan pertama. Paling aku risau apabila pendagang tidak memotong tax tersembunyi yang selama ini bersarang dalam produk dan khidmat yang kita gunakan. Peniaga Malaysia memang terkenal sebagai lintah darat yang suka sedut darah pengguna, sudah pasti mereka nak untung lebih dengan mengekalkan tax tersembunyi dan mengenakan pula gst sebanyak 6% jadi penggunakan akan bayar tax berganda.

Berikut adalah produk dan khidmat yang akan dikenakan GST dan yang tidak akan dikenakan GST bermula pada 1/4/2015.

Goods and Services Tax (GST) will be implemented effective April 1, 2015 and the rate is fixed at 6%. Sales tax of 10% and service tax of 6% will be replaced with GST. Under GST, most of the goods and services (except basic necessities) will be charged at every stage of the supply chain – even the ones that was previously not charged with Sales and Service Tax (SST). This means we will likely be paying more to purchase or use these goods and services, which were not taxed previously.

1. Credit card

The RM50 government tax charged annually on credit cards and the RM25 fee for supplementary cards, will be abolished from April 1, 2015 when the Goods and Services Tax (GST) is implemented. Instead, the 6% GST will apply on the credit card’s annual fees – which can range from RM70 to RM1,000 or more annually, depending on the type of card.

However, there will be no GST charges if the annual fee is waived, for example for free-for-life credit cards or those with annual fees waived, with stipulated minimum spending or transactions on a monthly or yearly basis.

To reflect the changes, the GST charged will be reflected as a separate item in the credit card statement. However, purchases will be reflected as a total amount inclusive of GST. There is some good news though, loyalty points or cash rebates will be given based on the 6% GST paid when using the credit card for retail purchases.

2. Books and e-books

The standard 6% GST will be imposed on all types of books except for dictionaries, encyclopedias, newspapers, texts, references, works and religious books. These books will be zero-rated and not be subjected to GST.

Local e-book suppliers like e-sentral and MPHonline will also be charging GST whereas foreign firms such as Google Play and Apple iBookstore would not be.

3. Housing

GST will also see basic construction materials such as cement, bricks and sand being taxed the standard 6% GST rate for both residential and commercial properties. Currently, these raw materials are not taxed under the existing SST. Heavy machineries such as cranes will be taxed too. Property developers normally do not buy such heavy machineries but rent them from other contractors – and it typically is factored into the construction cost.

Steel, bricks, and sand make up 44% of the construction cost and with these being charged GST, the cost of building a property is inevitably going to increase. Property companies expect GST to result in a maximum of 2.6% increase in house prices.

When the GST is implemented in April, residential property including SoHo (small office/home office) will be exempted. However, commercial properties including SoFo (small office/flexible office) and SoVo (small office/virtual office) would be subject to the 6% GST.

4. Fuel

RON95, Diesel and LPG (liquefied petroleum gas) will be exempted from GST implementation. However, RON97 will be subjected to the new 6% GST.

5. Electricity

A household will have 6% GST charged to the electricity bill for usage above 300 units.

6. Used cars

Currently, used cars are not subjected to SST and is not a GST zero rated item either. Therefore the car industry predicts that used cars will be subjected to an extra 6% tax after the implementation of GST in April.

7. Banking services

The RM1 MEPS fee charged when we withdraw from another bank’s ATM will increase to RM1.06. No GST will be charged if you make a withdrawal from your own bank’s ATM.

Similarly, other services offered by the bank, such as money transfers (e.g. cashier’s order and demand draft), telegraphic transfers, money exchange, loan, cheque, credit card, and debit card will see 6% GST charged to its service, commission or subscription fee.

8. Tuition fees

Beginning April, 6% GST will be imposed on tuition fees, as tuition centres are not categorised under educational institutions.

9. Beauty services

The price of beauty services like manicure, and hair and facial treatments will be subjected to 6% GST too. Massage services are also chargeable with the GST if the annual turnover for such businesses is RM500,000 and above. Aside from beauty services, cosmetics and other products for skin, hair and body care will also be charged GST.

However, operators registered to implement the GST will be able to lower their costs by claiming the input tax credit for premises rental fees, electricity costs and equipment purchased to carry out the services. Input tax refers to the GST paid by businesses on the purchase of goods and services used to perform their businesses.

Beauty products sold at airports as duty-free items will not be subjected to GST.

10. Insurance fees

All insurance policies except for life insurance will be charged 6% GST from April. GST would also impact all traditional and investment-linked policies which had medical, critical illness or personal accident benefits attached.

For traditional policies, the GST is imposed on the premium, while for investment-linked policies, it is charged on the insurance charges. For investment-linked policies, insurance charges will escalate with age because of higher insurance charges.

While it is still not clear how much prices will increase, or in some instances, decrease, it is prudent to know your exempted and zero-rated items to avoid opportunists merchants who may be profiteering on GST.

With less than a month away before GST is actually implemented, it is wise to understand how GST will affect both our daily or seasonal spending. This will help us to plan our spending ahead, to minimise the negative effect of GST

Aku melihat GST adalah suatu yang mencabar kepada Kerajaan yang perlu ditangani dengan terbaik kerana rakyat sedang melihat kesannya. Sudah pasti Pembangkang sedang mengambil kesempatan dan mereka akan berjaya sekiranya Kerajaan gagal membuktikan GST boleh mengurangkan beban ekonomi yang sedang dihadapi oleh rakyat.

Apa pendapat anda??

152 Comments

GST oh GST.. ape yg sy nampak lebih banyak keburukan dari kebaikan.. hmm..

Curahan rasa Haziq @ ..Pembiayaan Peribadi Serendah 4.35%

Kadang2 agak meletih bila kita membanding-banding dengan negara luar yang telah lama amalkan GST.

Nak ikut pelaksanaan GST di Asia dan di Eropah memang jauh beza tinggi dan cara kerajaan masing2 tangani pun lain.

Takpe kita tunggu dan lihat nanti.

Curahan rasa Azeni Ahmad @ ..Keluhan Wanita Tentang Sakit Belakang dan Lenguh Badan? Mengada atau Sebaliknya?

Macam ada orang tu cakap, tahun pertama dan kedua mesti tak boleh lari dgn GST dgn cas tersembunyi ni. Kalau kerajaan ambil langkah proaktif, dgn buat Ops sedia, tanpa masuk campur politician, memang boleh tangani peniaga tamak. Jangan cakap ja lebih, action kurang, tu rakyat marah sebab isu ni sebab tak beri manfaat kalau lepas GST tahun ke tahun barang naik.. Kami yg pekebun kecil ni pun fedup gak,ops jihad orang tengah tu macam hangat hangat tahi ayam saja. Alasan kakitangan tak cukup..dok kena main harga…

Curahan rasa Syahril Hafiz @ ..Malaysia Best Blog 2015

GST antara isu yang popular..namun GST adalah cara kerajaan menjana kewangan untuk mengurus negara..

Curahan rasa Hero Borneo @ ..Jangan Fobia Sertai Bisnes Networking

saya berharap sgt GST ni akan bagi kesan positif dan bukannya lebih membebankan.

Curahan rasa nikkhazami @ ..(Sinopsis) Hati Perempuan di Tv3

macam2 respon tentang GST ni.. tapi majoriti menolak perlaksanaannya. apa2 pun kita kena kerja kuat lepas ni

Curahan rasa nikkhazami @ ..(Sinopsis) Hati Perempuan di Tv3

memang ada byk spekulasi pasal GST ni, tapi saya berharap, ianya akan memberikan kesan positif kepada rakyat sekiranya dilaksanakan secara telus. Penguatkuasaan and pemantauan daripada pihak berwajib perlu supaya tidak ada peniaga yang mengambil kesempatan dengan sistem percukaian baru ini.

Curahan rasa kimmie @ ..Melaka Wonderland Theme Park & Resort

banyak spekulasi pasal GST ni, ramai yg mula membeli brg keperluan untuk elakkan kena GST. Habis jer brg keperluan mesti kena beli lagi. Apapun kena hadapi, insyaAllah. kena tenang jer 😀

Curahan rasa cikjan @ ..Jangan Pilih Yang Murah Jer, Baca Betul-Betul : Destinasi Cuti Sekolah

Tuition fees pun kene gst. Ada la alasan budak2 lepas ni untuk tak pergi tusyen

Curahan rasa Bro Ley @ ..Peluang hidup kali kedua

makin nak dekat bulan April, makin jadi takut pula..apa-apa pun kena persiapkan diri..perbelanjaan kena kawal betul2..dan kena usaha untuk tambah pendapatan..

Curahan rasa MamaBard @ ..Hinakah Menjadi Hanya Seorang Suri Rumah?

saya sendiri sebenarnya pun pening, ada yang kata gst akan naik harga barang dan ada yang kata turun. pening juga, malah saya dah tgk kira kira ada yang naik dan ada yang turun, cuma mcm ni jer lah, kalau naikpun harga barang harap x melampau la sebab 6% jer, peniaga jgn ambil kesempatan, kalau turun harga semua rakyat suka

Curahan rasa BESTMobile Telco @ ..Buat Duit Dengan Menjadi Agen Topup STK BESTMobile

GST…tunggu dan lihat kesannya ke atas rakyat, nak-nak lagi golongan pertengahan macam saya….serammm sebenarnya nak tunggu bulan april ni

Curahan rasa siti hazreen @ ..Permohonan Program Khas Kejuruteraan Jepun, Korea, Perancis dan Jerman Tahun 2015

Entahlah labu, terlalu bnyk terbaca hal-ve ttg gst tapi hari2 dihidangkan dgn hal+ve ttg gst…. tunggu dan lihat aja lah kuasa pembeli vs kuasa penjual vs kuasa kerajaan memantau sama ada lebih ok atau x berbanding sblum gst

Curahan rasa ezaiza @ ..Software download video etc dari Youtube sampai lebam! : YTD Video Converter

Buku dan ebook pun kena GST.. Nampaknya makin mahal harga-harga ebook yang dijual oleh para IM selepas ini…

Curahan rasa Anuar @ ..Semua kanak-kanak seronok bekerja di Kidzania Malaysia, Kuala Lumpur

Dalam dilemma dengan gst ni.. Tunggu jela sampai masanya nanti.. Rasa serabut Kalau fikir lama lama

Curahan rasa Weschairs @ ..Mee Kuah Tulang, Bukit Minyak

Comments are closed.